prince william county real estate tax rate

December 5 annually Business Gross Receipts BPOL. Contact each County within 60 days of moving to avoid continued assessment in the County you are no longer living in and to be assessed accordingly by Prince William County.

Virginia Property Taxes By County 2022

Taxes may be going up in Prince William County after July 1 with a proposed boost in real estate tax bills a new cigarette tax and an increase in the.

. Then they get the. Jul 06 2020 Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. Learn all about Prince William County real estate tax.

Payments for taxes may be made online or by telephone using a credit or debit card. Personal Property Taxes and Vehicle License Fees Due. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

Proceso de pago en espanol. Prince William County collects on average 09 of a propertys. Property taxes in Prince William County are due on June 5th.

By creating an account you will have access to balance and account information notifications etc. Second-half Real Estate Taxes Due. Prince Williams board of supervisors is moving toward adopting a budget for fiscal year 2021 that keeps the countys real estate property tax rate flat while increasing the data.

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local. Local real estate tax bills are likely still going. Property taxes in Prince William County are due on June 5th and are paid to the Commissioner of the Revenue.

Hi the county assesses a land value and an improvements value to get a total value. Enter the Tax Account numbers listed on the billing. FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. At Tuesdays Board of Supervisors meeting county officials proposed a further reduction in the real estate tax rate from 1115 per 100 of assessed value to 103 in the. 4379 Ridgewood Center Drive Suite 203.

Prince William County Real Estate Assessor. Prince William County Virginia Home. 703 792 6780 Phone The Prince William County Tax.

Prince William Virginia 22192. Allegany County Tax Utility Office 701 Kelly Road Suite 201 Cumberland Maryland 21502. Payment by e-check is a free service.

Click here pay online. All you need is your tax account number and your checkbook or credit card. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States.

Office of the Treasurer. The Prince William Board of County Supervisors is poised to reduce the countys real estate property tax rate for the first time. Press 2 for Real Estate Tax.

There are several convenient ways property owners may make payments. Press 1 for Personal Property Tax. When prompted enter Jurisdiction Code 1036 for Prince William County.

Search 703 792-6000 TTY. If you have not received a tax bill for your property and believe you should have contact. You can pay a bill without logging in using this screen.

The real estate tax rate for the 2019 tax year is 120 per 100. PAY TAXES ONLINE OR BY TELEPHONE. If you have questions about this site please email the Real Estate.

A convenience fee is added to payments by credit or debit card. If you have questions about this site please email the Real Estate. The real estate tax rate for the 2019 tax year is 120 per 100.

How property tax calculated in pwc.

Best Places To Live In Prince William County Virginia

Insight Virginia State And Local Tax Issues For Virginia Based Data Centers

The Coalition To Protect Prince William County Unless Someone Like You Cares A Whole Awful Lot Nothing Is Going To Get Better It S Not The Lorax

Virginia Property Tax Calculator Smartasset

Market Statistics Realtor Association Of Prince William

Prince William County Va Businesses For Sale Bizbuysell

The Rural Area In Prince William County

Prince William Could Steal Loudoun S Title Of Data Center Alley But Land Use Battles Are Raging Virginia Mercury

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

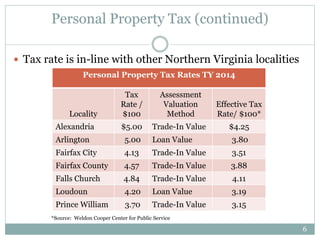

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Fairfax County Major Revenue Sources

The Battle For Northern Virginia Saturation Point For Data Centers Dcd

5 Things Agents Need To Know About The Tax Grievance Process Property Tax Grievance Heller Consultants Tax Grievance

Insight Virginia State And Local Tax Issues For Virginia Based Data Centers

New Property Tax Rates Northern Virginia

About Prince William County Virginia Northern Virginia Real Estate The Moyers Team